Quality. Performance. Legacy.

Harnessing wealth as a force for freedom.

Invest In American

Real Estate

Invest In American

Real Estate

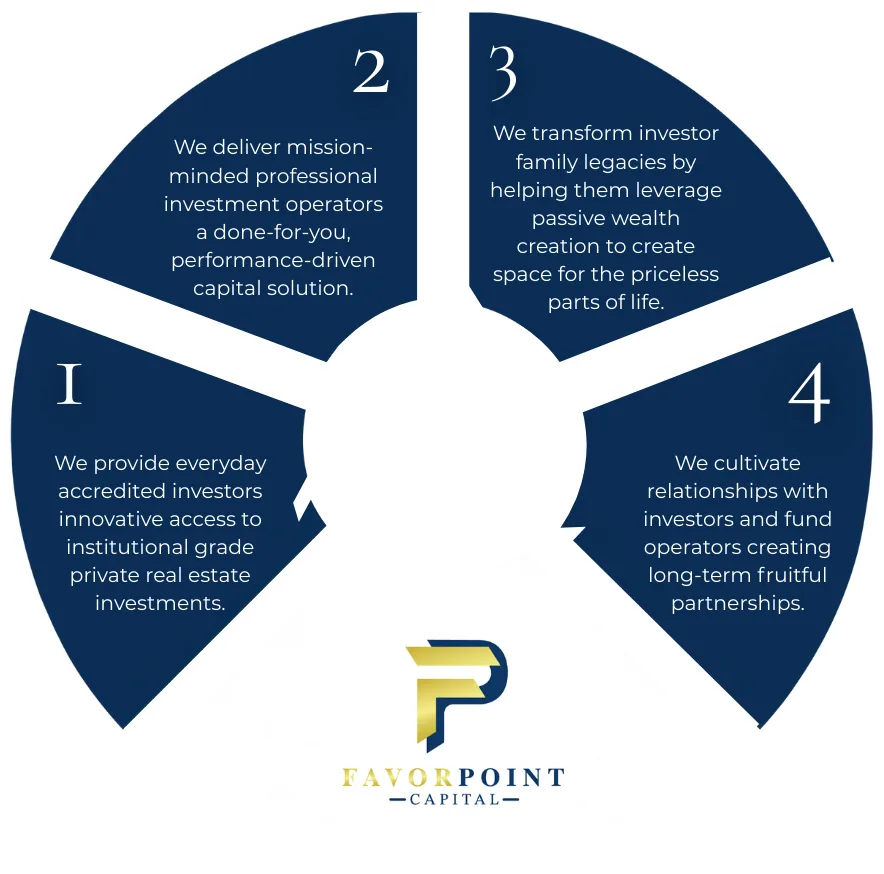

We Unlock Institutional Grade1 Private Real Estate Investments For The Everyday Accredited Investor

How We Help You

Everyday Accredited Investors

Retail Investor Growth: $0.5T to $6.4T | Alternative Investments Market | CAGR: 16.6%

Sources:

*Cerulli Associates – U.S. Alternative Investments 2024 Press Release https://www.cerulli.com/press-releases/alternative-investments-aum-growth

BlackRock / Preqin – 2025 Private Markets Outlook https://www.blackrock.com/institutions/en-us/insights/private-markets

iCapital – 2024 Alternatives Market Outlook https://www.icapital.com/insights

KPMG & Strategic Insight – Taking the Retail Alts Plunge? (2016) https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2016/09/taking-the-retail-alts-plunge.pdf

Morgan Stanley & McKinsey – Private Markets Distribution Report 2024 https://www.morganstanley.com/articles/private-market-access

Apex Group – Retail Alternatives Survey 2025 https://www.apexgroup.com/insights/democratization-of-alternative-investments

Infosys Insights – Democratizing Alternative Investments https://www.infosys.com/insights/democratizing-alternative-investments.html

Nasdaq / Prometheus – Alts for All: Growth of Alternative Investments https://www.nasdaq.com/articles/retail-access-to-alts

Opportunity For Everyday Accredited Investors

Alternative investments have surged from $4.6 trillion to $13.3 trillion over the past decade, becoming one of the fastest-growing asset classes. As institutional demand rises and financial advisors increasingly recommend higher allocations, access for most accredited investors remains limited. This disconnect creates a powerful wealth-building opportunity and we believe you should have access to it too.

FavorPoint Investor Advantage

Multi Party Due Diligence

We have multiple parties including ourselves, family offices, professional bankers, and legal firms performing due diligence on all the investments we offer, all at no direct cost to you.

Better Deal Terms

We leverage the collective investing power of our clients to negotiate a more advantageous preferred deal terms for our investors so you can get institutional level terms without large institutional capital.

No Projections, Only Historical Results

Any investment can “project” a great outcome, but that doesn’t mean it's going to happen. We only offer investment opportunities with a strong historical track record of producing market competitive returns.

No AUM or Retainer Fees

Unlike financial advisors, we do not charge investors ongoing asset-based fees or retainers directly. Instead, our placement fee is paid by the fund itself when you invest.

In Your Best

Interest

As a registered Broker/Dealer, we are held to the Regulation Best Interest standard. This means we must place your best interest above our own.

Registered Broker

As a Registered Broker Dealer, we are reviewed, registered and are held to certain standards that are not placed on other unregulated funds or sponsors who raise money directly.

Do I Qualify?

Individual

$1M NET WORTH

DOES NOT INCLUDE PRIMARY RESIDENCE

// OR //

$200,000 HOUSEHOLD INCOME

Married

$1M NET WORTH

DOES NOT INCLUDE PRIMARY RESIDENCE

// OR //

$300,000 HOUSEHOLD INCOME

63 Point Investor Protection Review

Every FavorPoint offering undergoes a rigorous 63-point evaluation to ensure key investor protections across critical areas.

Fair & Transparent Fees

We review sponsor fee structures—acquisition, management, financing, and development charges—to ensure they are competitive and fully disclosed to investors.

Capital Priority & Profit Sharing

We evaluate how each offering handles the return of investor capital and profit distributions, aiming for clear waterfalls and well-defined return calculations.

Governance & Investor Rights

We examine voting rights, key-person provisions, and manager-removal mechanisms so investors have a voice in significant decisions where appropriate.

Financial Reporting & Disclosure

We look for robust, regular financial reporting, independent audits, and timely tax documentation to keep investors informed about performance and material events.

Conflict Management

We assess related-party transactions, affiliate relationships, and side-letter arrangements to promote alignment of interests and fair treatment of all investors.

Regulatory & Tax Compliance

We monitor offerings for adherence to applicable securities regulations, tax elections, and investor-privacy requirements to help maintain compliance across jurisdictions.

Capital & Liquidity Provisions

We review capital-call mechanics, reserve policies, and transfer or redemption options to understand how investor capital is protected and how liquidity might be provided.

Risk Management & Insurance

We evaluate each sponsor’s approach to leverage, interest-rate hedging, construction oversight, and property insurance to gauge how key risks are addressed.

FavorPoint Capital conducts thorough reviews of these areas for every opportunity, but the specific protections and terms vary by offering and are determined by the sponsor and governing documents. Investors should carefully review each Private Placement Memorandum and related agreements before investing.

100+ Point Institutional Grade Due Diligence

Every FavorPoint offering goes through a 100+ point institutional grade due diligence spread across the following areas:

Financial Modeling & Fund Economics

We analyze full fund models to understand projected cash flows, profit splits, leverage assumptions, and sponsor incentives.

Fee & Expense Review

We benchmark all sponsor and fund fees against market norms to confirm they are reasonable and clearly disclosed.

Risk & Stress Testing

We model conservative and worst-case scenarios to evaluate performance under adverse market, debt, or operating conditions.

Background & Reputation Checks

We conduct comprehensive background, litigation, and social-media reviews on the sponsor and key principals to uncover potential red flags.

Sponsor Inputs & Representations

We collect and review documentation from the investment sponsor on planned leverage, exit strategy, reserves, and self-identified risks.

Document & Data Collection

We review fund, property, and third-party reports to substantiate key assumptions.

Governance & Control Review

We examine governing documents to understand decision-making authority, investor consent rights, and key-person protections.

Ongoing Monitoring & Verification

We periodically review updated documents and actual results throughout the investment lifecycle.

These categories describe the areas FavorPoint Capital focuses on when evaluating offerings. The specific procedures and depth of review may vary by investment, and investors should rely on the final Private Placement Memorandum and related agreements for binding terms.

Our Higher Purpose

FavorPoint was founded by two Christian entrepreneurs who believe money is simply a tool to serve a greater mission.

Fighting Child Trafficking

We're committed to combating child sex trafficking - a cause that deeply breaks our hearts.

Our Rescue Mission

Fund the rescue and rehabilitation of 10,000 victims of child sex trafficking.

Beyond financial returns, we're building a legacy of meaningful impact, transforming lives through the prosperity we create together.

Frequently Asked Questions

Interested Investor

Active Investor

Click Image To Explore The FavorPoint Difference

1 Institutional Disclaimer: “Institutional-grade,” “institutional-quality,” and “institutional-mindset” each refer to FavorPoint’s internal 100-plus-point due-diligence process, evaluating dozens of opportunities and presenting only those that meet our internal standards, along with efforts to negotiate preferred investor terms. These steps do not eliminate risk or guarantee performance. All investments involve risk, including possible loss of principal, and are intended for accredited investors only.

CONTACT US

Address: 16220 N. Scottsdale Road, Suite 300, Scottsdale, AZ 85254

The information on this website is for informational purposes only. Nothing included on this website should be construed as an offer to sell nor a solicitation of an offer to buy any security. Investments offered will only be available to those investors meeting the definition of Accredited Investor under Rule 501(a) of the Securities Act of 1933 and will only be offered via a confidential Private Placement Memorandum (“PPM”). This material should not be construed as tax or legal advice. Please consult with your trusted advisor(s) before making any financial decision. There are substantial risks with any private investment including general market conditions, lack of liquidity, lack of operating history, interest rate risk, general economic risks, construction and development risks, and potential for changes in tax law. Past performance is not indicative of future results. Investors should not be willing to invest in private placement offerings unless they can afford to lose their entire investment.